Cryptocurrency for nonprofits is becoming more accessible as its popularity and validity increases. But – it is also a very nuanced type of currency. As crypto donations become viable, more organizations want to know: what is cryptocurrency?

To understand cryptocurrency for nonprofits, you must first understand the:

- Technology behind it

- Differences between the various types (tokens vs. coins)

- Way in which it derives value

Step two is determining whether accepting crypto donations is the right choice for your organization – but more on that later.

Let’s dig in.

What is Cryptocurrency?

The answer to “what is cryptocurrency” in the simplest of terms is that it is:

- Digital: Despite the images of shiny gold coins, cryptocurrency does not have a physical form.

- Decentralized: There is no government or institutional oversight of cryptocurrency. Instead, it is managed by a peer-to-peer network of computers.

You may hear people use the term “coin” and “token” as if they mean the same thing but they are two different things.

- Coin: Created on its own blockchain. A coin stores value and you can exchange them between parties. An example of a coin would be Bitcoin.

- Token: Created on top of an existing block chain. Tokens verify identity, grant access, or certify something as “unique.” Non-fungible tokens, or NFTs, are an example of tokens, like those created by Ethereum.

It has been estimated that there are over 4,500 different types of cryptocurrency.

Only a handful are widely known, including:

- Bitcoin

- Ethereum

- Binance

- Cardano

- Dogecoin

- Tether

Like fiat (cash) money, you can use cryptocurrency to make purchases or you can hold it like an investment.

Key Concepts to Understand About Cryptocurrency

The use of cash currency occurs within our standard financial systems. In most cases, there is a go-between that handles the exchange of cash between two parties.

These mediators include companies like Visa, PayPal, Western Union, or your bank.

There are some core elements about cryptocurrency for nonprofits that one should understand. Especially before making decisions about accepting crypto donations.

The following concepts are at the very heart of why cryptocurrency has seen a rise in popularity and use.

Transferability

Cryptocurrency is a decentralized digital currency. This means that it is not subject to government regulation or oversight. This also means that there is no use for mediators, like your bank, in transactions.

Instead, you exchange cryptocurrency over the blockchain.

Mediators slow down the exchange of money and charge hefty fees. Without them, cryptocurrency transactions are:

- 60x more cost-effective

- 48x faster than a wire-transfer

This is one of the main reasons why cryptocurrency has the potential to be the next big evolution in currency. Without interference from traditional financial systems, money can be exchanged globally without long waits or hefty fees imposed by institutions or governments.

Privacy

It is not necessary to provide personal information to complete a cryptocurrency transaction.

For consumers, privacy is becoming increasingly important. iPhone users opted out of app- tracking at an alarming rate, pushing privacy conversations to the forefront.

One of the most important elements of cryptocurrency is privacy. There is no need to hand over sensitive financial information to third parties.

In a future article, we will dig into this a little more. However, crypto donations can remain private while still ensuring nonprofits get some of the information necessary.

Security, Transparency, and Safety

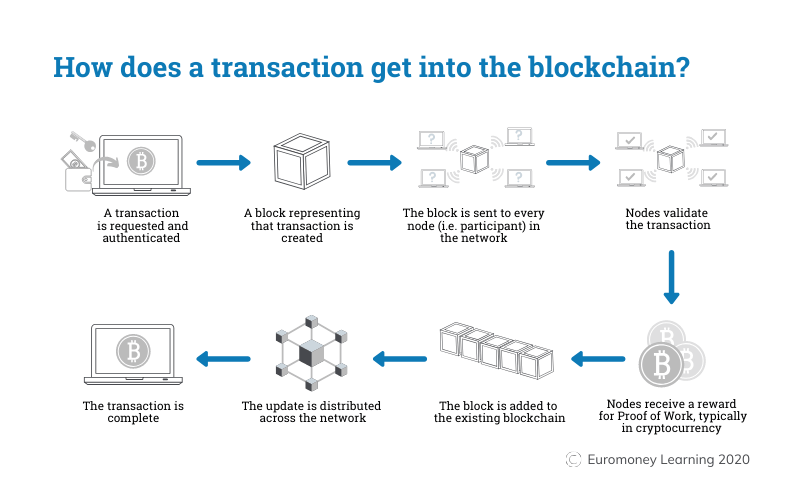

You may be wondering how safe cryptocurrency is without government oversight. Thanks to the use of a technology called “blockchain” (which vets and records all transactions), cryptocurrency is an incredibly safe form of currency.

The use of “blockchain” technology ensures that cryptocurrency transactions remain safe and secure.

Blockchains vet and record all transactions. It’s like a balance sheet or a ledger. A blockchain checks and re-checks each transaction. Each type of cryptocurrency has its own.

It is impossible to bypass or manipulate the transaction records in a blockchain. And, unlike cash, you cannot create counterfeit cryptocurrency.

The core software is open-source and the systems do not need permission. These two elements are part of the foundation on which cryptocurrency was built.

Its open-source and permissionless nature is what ensures crypto remains safe.

Computer scientists and cryptographers are able to check the security of the network at any given time.

How is the Value of Cryptocurrency Assessed?

There are two main drivers that contribute to the value of cryptocurrency.

Let’s dig in.

Supply and Demand

A large portion of crypto’s value is based on supply and demand. As with anything:

- High demand + low supply = increased value.

- High supply + low demand = decreased value.

The value of any given cryptocurrency will fluctuate – much like the stock market. Some types of cryptocurrency have leaned into inflation management policies or procedures, such as:

- Bitcoin has a fixed supply, as well as a 21-million cap on production written into its source code.

- Ethereum has a fixed supply and an issuance schedule which limits the release of coins.

- Tether is anchored to the US-dollar to keep its value stable.

Some cryptocurrencies have no cap on supply. Looking back at our formulas for value, this means supply can outweigh demand, decreasing the value of the currency.

Like What You're Reading? Subscribe Here!

Newsletter Opt-in

Production

Cryptocurrency is produced via a process called “mining”.

In simple terms, mining is solving a very complex math problem to verify the next block in the blockchain. Coins or tokens are the “prize” for verification of blocks.

As we said above, some types have an issuance schedule in regards to mining – like Ethereum.

The number of active users, transactions, or market value does matter – the issuance schedule remains. Upon block verification, Ethereum places two tokens into circulation.

While we have tried to make it seem simple, mining requires quite a bit of know-how and computing power.

Miners must buy expensive equipment (and factor in electricity costs) to mine cryptocurrency. The more competition in mining, the harder it becomes. This means more time, equipment, and power.

As the cost to mine increases, so does the value of cryptocurrency.

Money is Evolving

As it has done since the days in which we bartered for goods, money is evolving and it will continue to do so. Though cash is still king, cryptocurrency is positioning itself to be the next evolution.

The untapped potential for fundraising with crypto donations is significant. In August of 2021, the total market value of cryptocurrencies hit $2 trillion.

Understanding cryptocurrency for nonprofits is critical if you’re considering accepting cryptocurrency donations. Soon, we will share some tips for making assessments about cryptocurrency for nonprofits. What are the risks? What are the benefits?

Coming Soon: GiveWP Bitpay Gateway for Crypto Donations

Later this month, look out for a new crypto donation payment gateway for GiveWP! As we work to roll out our BitPay payment gateway, keep an eye out for more information. You can also monitor the progress on our roadmap.

BitPay will allow your donors to transact in crypto while giving your nonprofit options. BitPay will work in two ways:

- Your nonprofit can opt to cash out crypto donations immediately. When a donor submits their crypto donation to your organization, your organization will receive the cash value of that crypto donation.

- If you choose to, you can also maintain a digital wallet and handle your crypto donations on your own.

Should you choose to maintain your own digital wallet, you’ll need to pay close attention to the market value of your currency.

One of the downsides of cryptocurrency is that it can be volatile. Managing your own wallet will require an additional level of understanding and knowledge. We’ll explain more about this in another article.

If you don’t have a GiveWP pricing plan yet, get one now to gain access to the BitPay payment gateway when it’s ready.

Amplify your fundraising with a GiveWP Plan