In a statement to their customers, Amazon bemoaned the idea that with so many eligible organizations they felt the impact of the program was spread too thin.

Amazon has opted to make a one-time donation to the charities that have been part of the Amazon Smile donations program. This donation will be equivalent to three months of the charities’ 2022 earnings. Once the program ends for good, Amazon plans to shift their focus and invest in other areas, where their impact will be greater.

After Amazon’s announcement, we asked on Twitter how people were feeling about the end of the Smile program. The overwhelming majority were upset, citing the smaller nonprofits they support through Amazon Smile that appreciate the extra boost in funds.

The End of Amazon Smile Donations: How to Make Up for Lost Fundraising Revenue

While the end of the Amazon Smile program signals a loss to the nonprofit community, we see it as an opportunity to host your own donation site instead of relying on third-party platforms.

When you host your own donations, you control everything and can avoid losing donations when programs like Amazon Smile shut down or when Facebook goes down.

There’s an additional benefit of hosting your own donation site too. You can create meaningful relationships directly with your donors, pass on tax benefits, and diversify how donors can support your cause. No one can represent your organization as well and as personally as you!

Let’s dig into some of the meaningful ways your nonprofit can make up for the loss in funding from Amazon Smile.

Keep More of Your Donations with Fee Recovery

As you probably know, processing donations through payment gateways typically comes with a processing fee — a fee that often gets passed along to your nonprofit. PayPal fees are usually 2.9% + 30¢ per transaction. Stripe fees are the same. All payment gateways charge some kind of fee that hovers around an average of 3%.

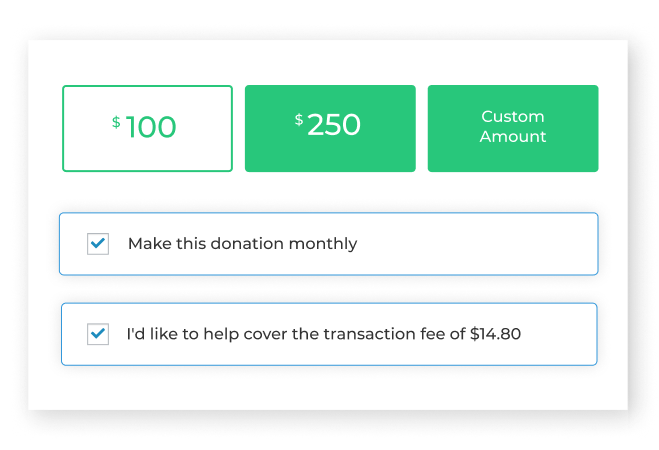

However, with GiveWP’s Fee Recovery, you can ask your donors to cover the cost of the processing fees for you. It’s a simple process and one that is essentially frictionless for your donors.

Fee Recovery (which is included in our Plus, Pro, and Agency plans) presents your donors with a simple checkbox. The checkbox asks if they would like to cover the transaction fee associated with their donation amount.

Once the box is selected, the fee amount is automatically added to their donation, and your donor can rest assured that their full donation amount is going to your cause instead of pesky payment processing fees.

This simple change can create meaningful revenue and help make up for the loss of funding through the Amazon Smile donation program.

Claim an Extra 25% on Your Donations Through the UK Gift Aid Program

Gift Aid is a government subsidized program in the United Kingdom that allows charitable organizations to “reclaim” the basic tax rate that taxpayers in the UK pay. Basically, that means that your UK-based charity can claim an additional 25p per every £1 donated.

The Gift Aid add-on not only makes it very easy for your donors to opt-in, but it also ensures that your donors have a clear understanding of the Gift Aid program, how it works, and what Gift Aid means to your organization.

Upon activation, the Gift Aid plugin presents donors with a box to tick as well as a brief description of the Gift Aid program directly on the donation form. Additionally, donors have the option to learn more about the program by selecting “Tell me more.”. This selection links to a more in-depth explanation of the program without taking your donor off-site.

The “Gift Aid” content is fully customizable to your specific needs, and many of the options can be enabled or disabled per form. There are several other benefits included with our Gift Aid add-on like declaration forms, smart address detection, country detection, and more.

Diversify How Donors Can Give with Mobile Giving Options

Mobile giving allows you to meet your donors where they are: on their phones. While we all know how much time we spend on our personal devices (thanks, Screen Time!), these numbers from Nonprofit Source underscore just how valuable mobile giving is:

- 1 in 4 donors discover nonprofits they were previously unaware of via their mobile devices.

- 25% of donors use their mobile devices to complete donations.

- Mobile giving has seen an increase of 205% since 2021.

- In 2021, nearly half (49%) of mobile donations came from texts.

- Responsive website design doubles giving on mobile devices.

- $107 is the average text-to-give donation size.

But what exactly do we mean when we say “mobile giving”? Great question. Effective mobile giving encompasses a number of features and tactics such as text-to-give, mobile-responsive site design, express checkout, and payment options like Venmo.

- Text-to-Give: Allows users to send a message to a specific phone number with their donation amount.

- Mobile-responsive design: Websites and donation forms that are mobile-responsive automatically adjust to the screen and device the donor is using. GiveWP ensures that your donation forms are easy to read and use on every device.

- Venmo donations: This payment app is one of the most widely used payment platforms available on mobile devices. Since the payment experience is already familiar for many people, you can create a positive donation experience for your supporters. If you’re already using PayPal, it’s super easy to enable Venmo donations — just toggle it on!

One of the most important things to consider in your fundraising strategy is one that meets your donors where they are. For more best practices and information on mobile giving, check out “Why Mobile Giving Needs to be Part of Your Fundraising Strategy.”

Tout the Tax Benefits and Provide Donors with Annual Receipts

One part of charitable giving that sometimes feels taboo to talk about are the tax benefits associated with charitable giving. Though donors historically give to causes they care about, many also want to get their tax break at the end of the year.

For those donors who don’t take a standard deduction, providing Annual Receipts allows you to make it easier for them to access their donation tax receipts with just a few clicks. You may be wondering what that has to do with retaining and increasing revenue, but let’s frame it around this concept: frictionless giving.

The harder it is for donors to claim their gifts — for instance, by having to hunt down each and every donation receipt from the past fiscal year — the more friction you create in the giving experience.

Organizations that provide their donors with annual receipts (and let them know upfront that you provide them!) often see better results retaining and converting recurring donors.

Build Better Relationships to Convert and Retain Donors

Increasing your donor retention rate should be a fundamental goal for your organization. Unfortunately, donor churn is sometimes inevitable and out of your control. Donors sometimes stop giving for reasons you have no influence over like a change to their income.

However, donors often churn for a reason you can control.

Communicating Impact

If you aren’t sharing the impact of your donor’s gifts, they may stop giving because they think you don’t need them. Be sure to keep donors updated on the impact their gifts have on beneficiaries by sharing stories and sending out impact reports.

Additionally, you may want to consider including impact units on your donation forms, giving donors the opportunity to see exactly how their gift impacts your organization as they give.

Thanking Donors

Without a proper thanks — meaning you thanked them and you did it through the best communication channel — donors may feel that your organization is not grateful for the monetary contribution(s) they have provided, and they may not give again.

Be Transparent About Spending

Donor impact reports have another advantage: they provide transparency to current and potential donors. Including data that tells the full story in your reports — fundraising success, how money was spent, and the impact it had on your organization — builds trust with supporters and ensures they feel that their contributions are being used effectively.

Stay in Touch

Would it surprise you to learn that some donors churn because they simply don’t remember that they gave to your organization? Ensure that you’re staying top of mind by communicating across multiple channels, like:

- Email and Newsletters: Marketing via email continues to be one of the highest converting communication channels for consumers — and your donors are consumers. Ensuring that you’ve got well-designed marketing emails that inspire giving is just one part of the email marketing equation. The other part is sending regular newsletters that keep your donors and supporters in the loop on what your organization is up to.

- Text Messaging: We’ve already covered how text messaging can increase your giving, but the other benefit is that it empowers your organization to keep in touch with people in places that may have less or slower internet access. It’s more likely your donors will read your messages on their phones.

- Social Media: Last year, we wrote about social media trends, and it doesn’t look like much is changing for 2023. While we certainly don’t suggest that your organization must have a presence on every social media platform, we do encourage you to do some research and determine which platforms your supporters are on. Additionally, creating social media toolkits can help your partners and supporters amplify your messaging for you.

Owning Your Land with GiveWP

We have always been proponents of hosting your own donations — like owning your home on the internet. It’s a conversation that comes up every time a social media site goes down, a payment gateway’s terms of service gets updated, or when programs like Amazon Smile come to an end.

Not only does owning your own donation system allow you to have ultimate control over your fundraising success, hosting your own donations with GiveWP opens up a world of opportunities for your organization to maximize your fundraising success.

We make it easy for you to raise more money online without relying on a third-party platform. Take GiveWP for a test drive today!